Canadian Small Business Health Index

The economic indicator for deeper Canadian Business Health insights

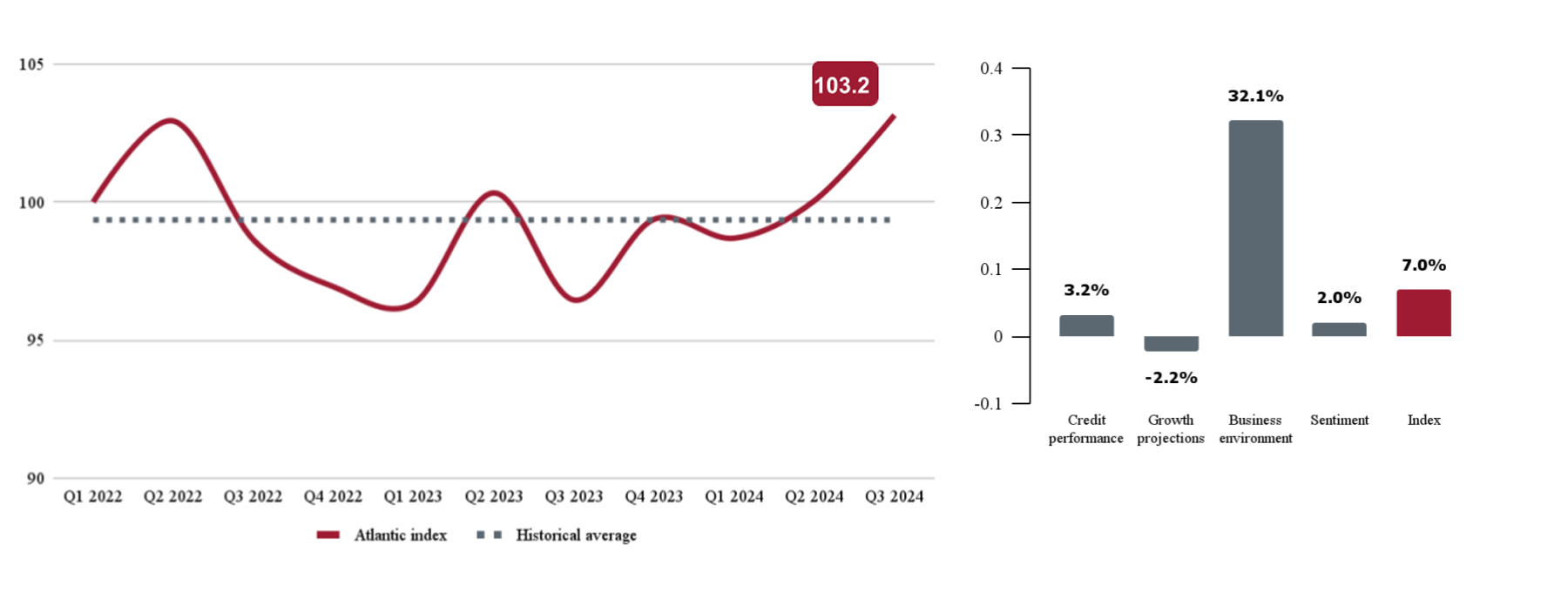

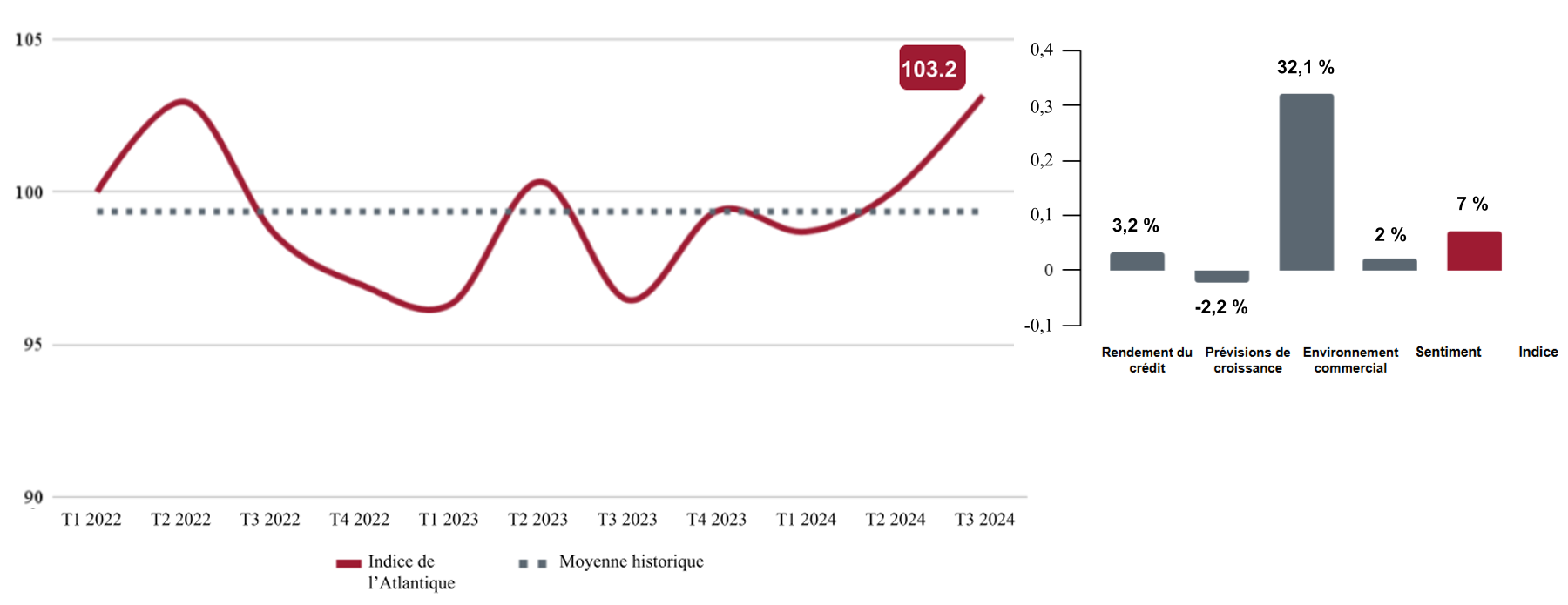

The Atlantic region, encompassing the Maritimes and Newfoundland, shows strong economic performance, outpacing the national average with 7.0% annual growth in Q3 2024. The strong performance in the region is being fueled by better business credit performance, robust employment and wage growth, and a thriving construction sector. Businesses are optimistic about the future, driven by a favourable economic environment and major projects underway. However, despite the rise in business openings and investment projects, concerns remain about sales growth due to cautious consumer spending, which may temper growth projections.

|

The Atlantic region, encompassing the Maritimes and Newfoundland, shows strong economic performance, outpacing the national average with 7.0% annual growth in Q3 2024. The strong performance in the region is being fueled by better business credit performance, robust employment and wage growth, and a thriving construction sector. Businesses are optimistic about the future, driven by a favourable economic environment and major projects underway. However, despite the rise in business openings and investment projects, concerns remain about sales growth due to cautious consumer spending, which may temper growth projections. |

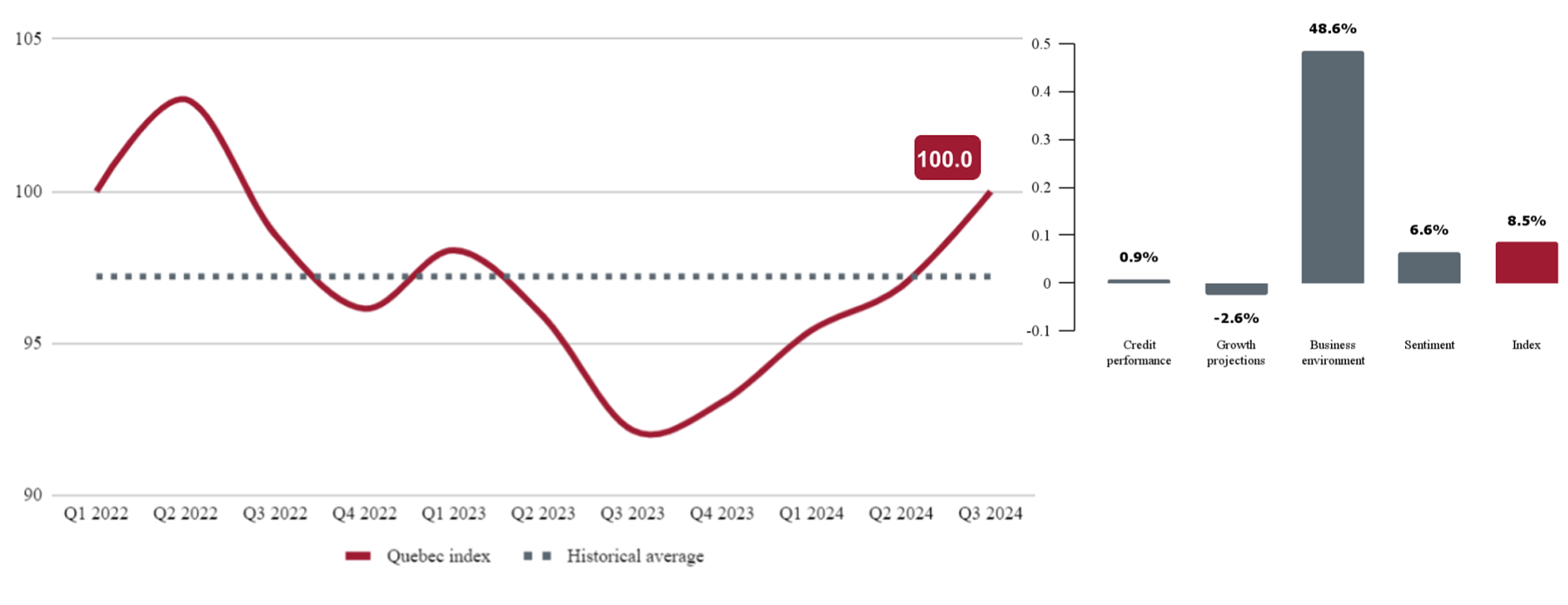

Quebec's business landscape is rebounding with strong improvement in Q3 2024, following a period of economic stagnation in 2023. The provincial index now stands at 100.0, marking a significant 8.5% growth year-over-year. This resurgence is largely fueled by a favourable business environment, supported by rising wages and a faster return to the Bank of Canada's inflation target. Businesses in Quebec are expressing greater optimism across the board, with strong investment intentions. However, these positive projections are being tempered by a 27% drop in credit inquiries and a 31% decline in new credit accounts, despite a 16% rise in business openings.

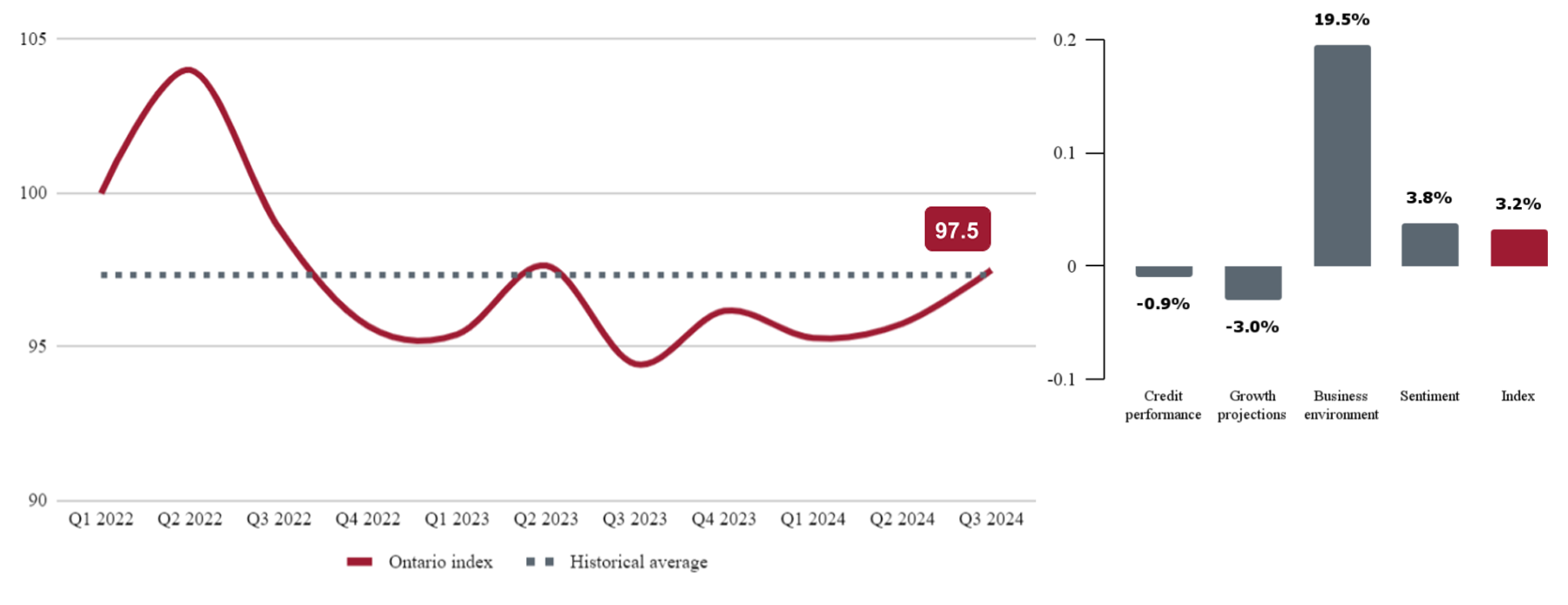

Ontario’s SMB sector is on the upswing, with performance improving since Q4 2023 and reaching an index score of 97.5 in Q3 2024—a 3.2% annual growth. Ontario tends to be more affected by interest rate hikes since it is more concentrated in interest rate-sensitive industries. The recent rate cuts are expected to potentially further fuel this upward trend in the coming months. Businesses are also generally more optimistic about future economic conditions and access to credit.

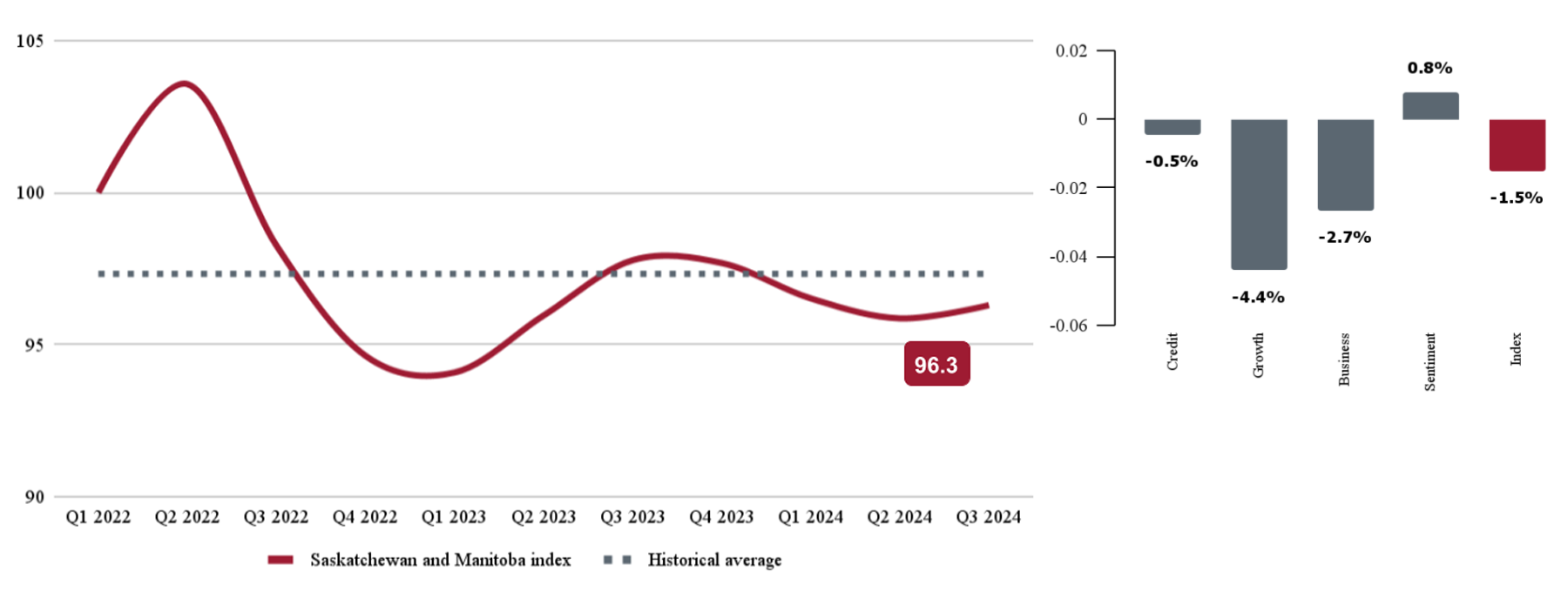

In Saskatchewan and Manitoba, the index has been oscillating for the past year. The index stood at 96.3 in Q3 2024—a 1.5% decrease year-over-year. Businesses in the region are demonstrating lower investment intentions for the next 12 months, and wage growth has slowed. Despite these challenges, the ongoing projects in Saskatchewan's mining sector have the potential to stimulate economic activity and boost the index in the coming months.

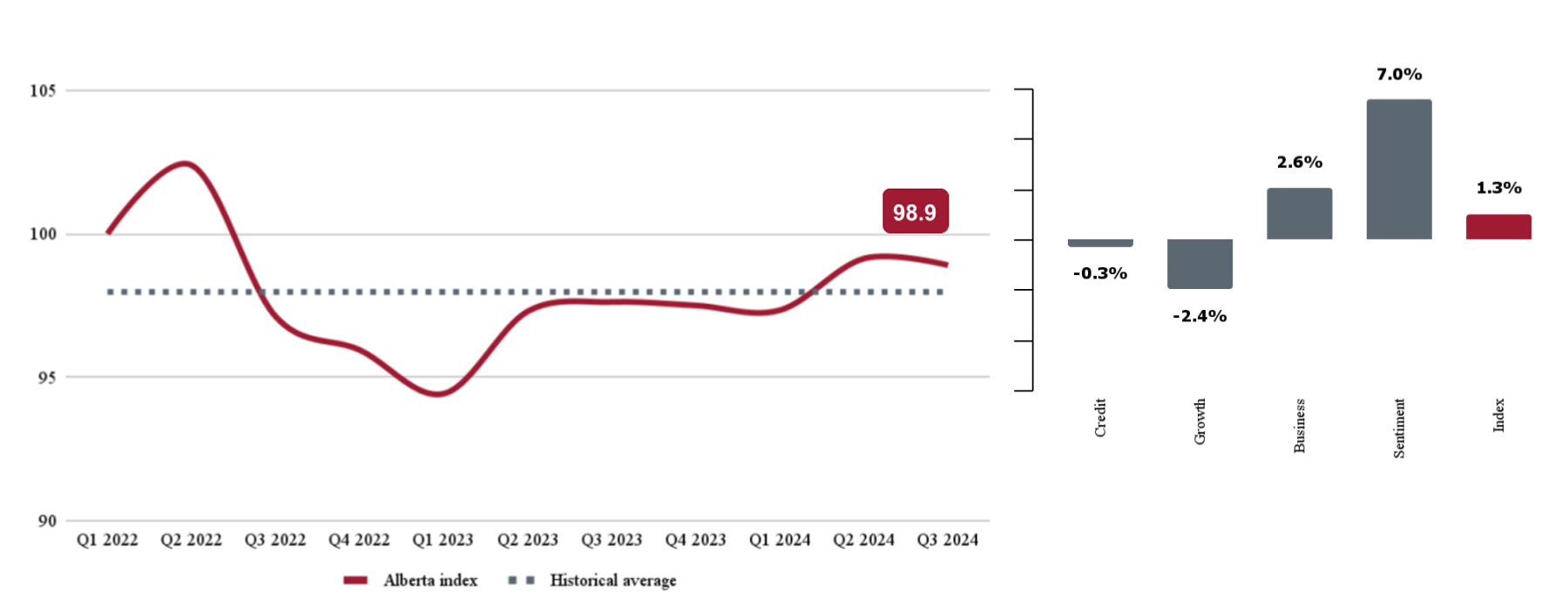

Alberta's index was not impacted by the Bank of Canada’s increase in interest rates. Their economy remains resilient, supported by a strong residential sector and the oil and gas industry, including the Trans Mountain Pipeline expansion, which should continue to support its businesses in 2024. Despite moderate 1.3% annual growth in the index, it remains elevated compared to other regions at 98.9. Business sentiment is strong, driven by a positive economic outlook. While growth projections are tempered by a decline in new credit inquiries and business openings, increased investment intentions suggest future expansion is possible.

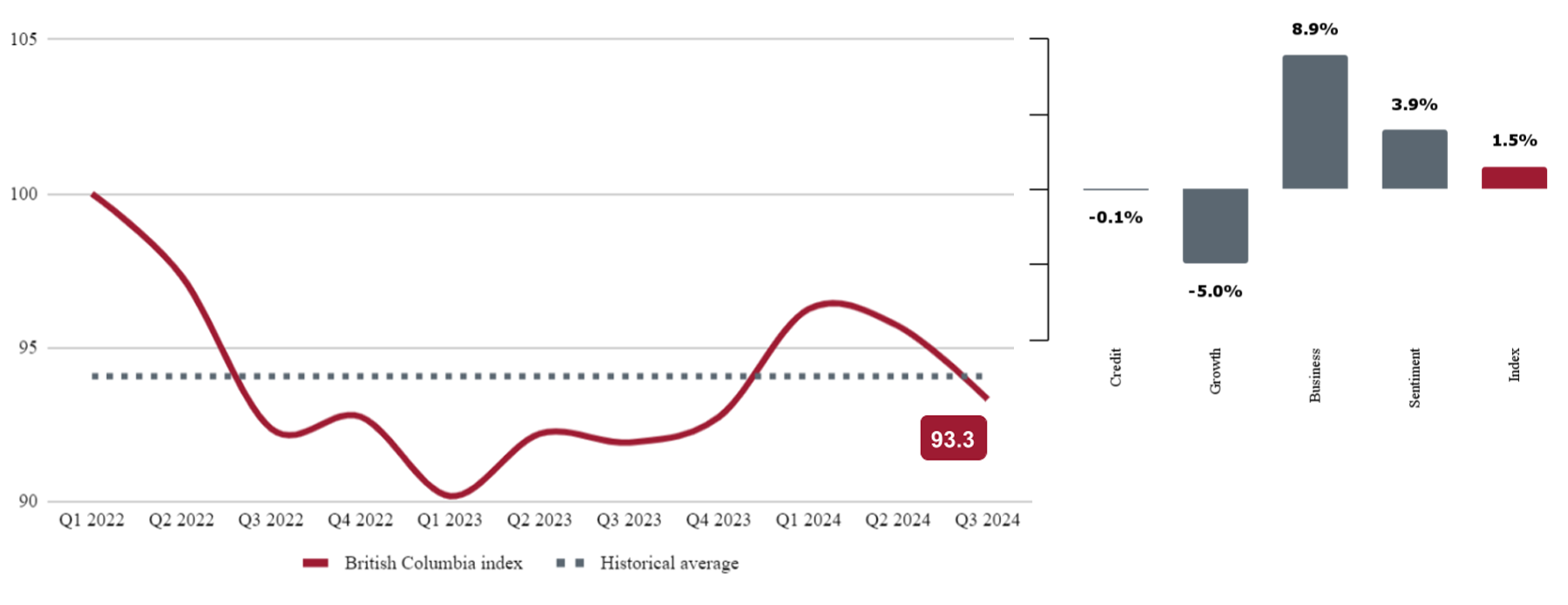

British Columbia's economic recovery is proceeding at a slower pace than other regions. Despite a 1.5% year-over-year increase, the index stands at 93.3 in Q3 2024, the lowest among Canadian provinces. A sluggish economy, coupled with high household debt and exposure to the housing sector, contributes to this trend. However, recent interest rate cuts could potentially provide some relief for businesses.